The global automotive glass market size is anticipated to reach USD 43.1 billion by 2027, according to a new report by Grand View Research, Inc., registering a CAGR of 4.5% over the forecast period. Growing emphasis on electric vehicles and new norms such as BS VI in India which would bring Indian motor vehicle regulations into alignment with European Union regulations are anticipated to drive the automotive glass production across the forecast period.

Despite the decline in automotive production in 2018 and 2019, the market is expected to witness growth on account of the rise in production of commercial vehicles and increasing product demand from the aftermarket. The increasing number of vehicles on the road, along with growing accidents, drives the need for repair, maintenance, and replacement, which would subsequently drive the demand for glass.

Innovation and technological advancements are the key factors driving the market growth. Various technological advancements are being witnessed in the applications of automotive glass. For instance, new features were introduced in windshields and sunroofs for luxury cars in 2019. Growing demand for smart glass technology is likely to drive the product utilization in windshields over the forecast period.

Increasing demand for commercial transportation services such as buses and taxicabs are anticipated to boost the demand for light commercial vehicles (LCVs). In addition, rapid urbanization, improved road infrastructure, and supportive regulatory policies are expected to boost the demand for LCVs, thereby resulting in market growth.

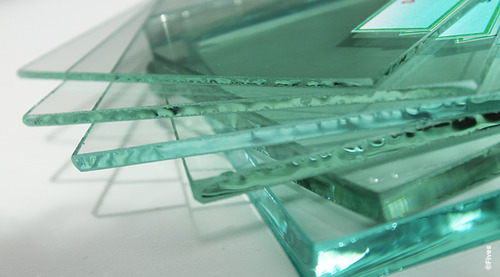

Tempered dominated the product segment in 2019. Rapidly growing commercial vehicle production in Asia Pacific is expected to drive the demand for tempered glass over the forecast period. Moreover, about 30,000 people are killed by road accidents every year in America. This has led to an increased focus on the development of vehicles with high safety levels, thereby driving the market growth.

Growing urbanization, increased spending capacity of consumers, and the development of the automotive sector in countries including Brazil and Argentina are anticipated to positively affect the market over the coming years. In addition, increasing electric vehicle production owing to supportive government policies is expected to drive market growth.

Further key findings from the report suggest:

- The laminated segment accounted for a significant share of 36.2% in 2019 in terms of volume. This is attributed to advantages such as safety features and its ability to block harmful UV rays

- Sunroof is expected to register the highest CAGR over the forecast period as a result of growing penetration of sunroof systems in affordable cars

- The OEM segment accounted for a share of about 80.0% in 2019 owing to the growing demand for commercial vehicles and automotive glass market.

- Europe is expected to register a CAGR of 4.6% over the forecast period on account of new plants and increasing prices in the region. For instance, in July 2018, BMW announced its plans to invest USD 1.71 billion (€1.5 billion) in a new car factory in Hungary

- AGC Inc.; Saint-Gobain; Fuyao Glass Industry Group Co., Ltd.; NSG Group, Limited (NSG); and Corning Incorporated are some of the prominent manufacturers worldwide. These companies supply glass directly to vehicle manufacturers.

Grand View Research has segmented the global automotive glass market on the basis of product, application, end use, vehicle type, and region:

Automotive Glass Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2016 - 2027)

- Tempered

- Laminated

- Others

Automotive Glass Application Outlook (Volume, Million Square Meters; Revenue, USD Million, 2016 - 2027)

- Windscreen

- Backlite

- Sidelite

- Sunroof

Automotive Glass End-Use Outlook (Volume, Million Square Meters; Revenue, USD Million, 2016 - 2027)

- Original Equipment Manufacturer (OEM)

- Aftermarket Replacement (ARG)

Automotive Glass Vehicle Type Outlook (Volume, Million Square Meters; Revenue, USD Million, 2016 - 2027)

- Passenger Car

- Light Commercial

- Heavy Commercial

Automotive Glass Regional Outlook (Volume, Million Square Meters; Revenue, USD Million, 2016 - 2027)

- North America

- US.

- Canada

- Mexico

- Europe

- Germany

- UK.

- France

- Asia Pacific

- China

- India

- Central & South America

- Brazil

- Middle East & Africa

About Grand View Research

Grand View Research, Inc. is a U.S. based market research and consulting company, registered in the State of California and headquartered in San Francisco. The company provides syndicated research reports, customized research reports, and consulting services. To help clients make informed business decisions, we offer market intelligence studies ensuring relevant and fact-based research across a range of industries, from technology to chemicals, materials and healthcare.